By Order of the Board of Directors

Laurie L. McClellan

Chairman

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant | ☑ |

Filed by a Party other than the Registrant | ☐ |

Check the appropriate box: |

| Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission only(as permitted by Rule 14a-6(e)(2)) | |

| Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Pursuant to Section 240.14a-12 |

CONSUMERS BANCORP, INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

☑ | No fee required. | |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

1. | Title of each class of securities to which transaction applies: | |

2. | Aggregate number of securities to which transaction applies: | |

3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

4. | Proposed maximum aggregate value of transaction: | |

5. | Total fee paid: | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

1. | Amount Previously Paid: | |

2. | Form, Schedule or Registration Statement No.: | |

3. | Filing Party: | |

4. | Date Filed: |

Preliminary Proxy Materials

CONSUMERS BANCORP, INC.

614 East Lincoln Way

P.O. Box 256

Minerva, Ohio 44657

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

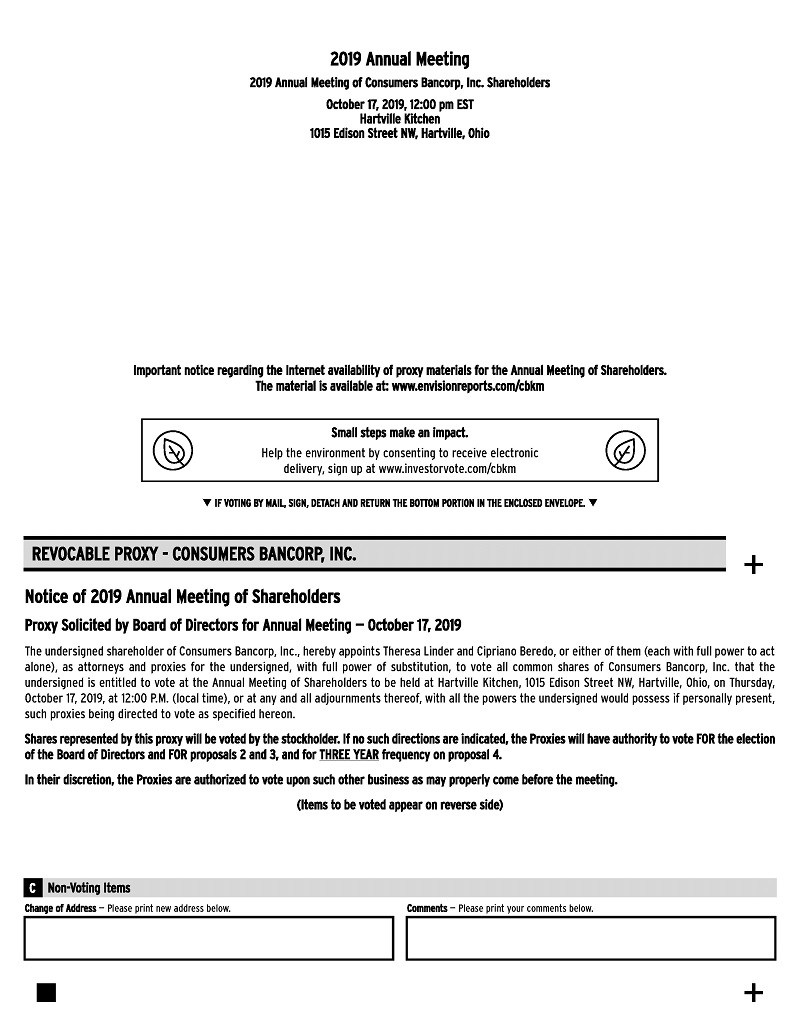

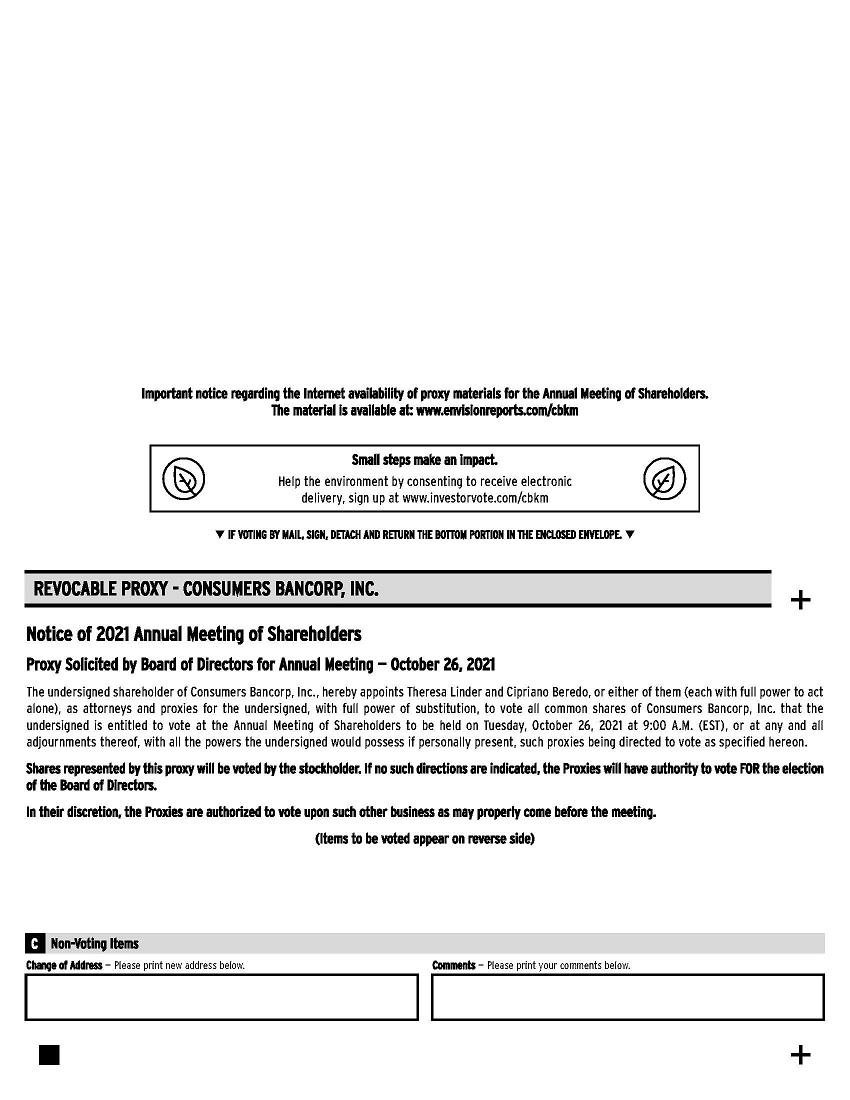

TO BE HELD ON OCTOBER 17, 201926, 2021

To Our Shareholders:

Notice is hereby given that the Annual Meeting of Shareholders of Consumers Bancorp, Inc. will be held at Hartville Kitchen, 1015 Edison Street NW, Hartville,Consumers National Bank Minerva Office Training Room, 614 East Lincoln Way, Minerva, Ohio, on Thursday,Tuesday, October 17, 2019,26, 2021, at 12:9:00 p.m.a.m. (local time), for the following purposes:

1. | To elect |

2. |

|

|

|

|

|

| For the transaction of any other business that may properly come before the meeting or any adjournment thereof. |

Only those shareholders of record at the close of business on August 28, 2019September 3, 2021 are entitled to notice of and to vote at the Annual Meeting of Shareholders and any adjournment thereof.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please sign, date and return the enclosed proxy card in the envelope provided or authorize your proxy electronically over the Internet as promptly as possible. Please refer to the proxy card enclosed for information on authorizing your proxy electronically. If you attend the meeting and so desire, you may withdraw your proxy by giving a written notice of revocation and vote in person.

By Order of the Board of Directors | |

|  |

Laurie L. McClellan Chairman |

Minerva, Ohio

September 12, 2019

16, 2021

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to Be Held on October 17, 201926, 2021

The proxy statement and annual report are available

at http://www.edocumentview.com/CBKM.www.envisionreports.com/CBKM.

CONSUMERS BANCORP, INC.

614 East Lincoln Way

P.O. Box 256

Minerva, Ohio 44657

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 17, 201926, 2021

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Consumers Bancorp, Inc. (the Company, Consumers or Consumers Bancorp) for use at the Annual Meeting of Shareholders (the Annual Meeting) to be held at Hartville Kitchen, 1015 Edison Street NW, Hartville,Consumers National Bank Minerva Office Training Room, 614 East Lincoln Way, Minerva, Ohio, on Thursday,Tuesday, October 17, 2019,26, 2021, at 12:9:00 p.m.a.m., local time and any adjournments thereof. The Company is requesting that attendees follow social distancing protocols and any guidelines issued by the Centers for Disease Control and Prevention (CDC) that are in place at the time of the meeting.

This Proxy Statement and the accompanying proxy are first being mailed to shareholders of record on or about September 16, 2019.21, 2021. It is contemplated that solicitation of proxies generally will be by mail. However, officers or employees of Consumers Bancorp or Consumers National Bank, a wholly-owned subsidiary of Consumers Bancorp, may also solicit proxies by electronic media without additional compensation. Consumers Bancorp will pay the costs associated with the solicitation of proxies.

Shareholders of record at the close of business on August 28, 2019September 3, 2021 are entitled to notice of and to vote at the Annual Meeting. As of August 28, 2019, 2,733,845September 3, 2021, 3,028,100 Consumers Bancorp common shares, no par value, were outstanding. Each shareholder will be entitled to one vote for each common share beneficially owned on all matters that come before the Annual Meeting.

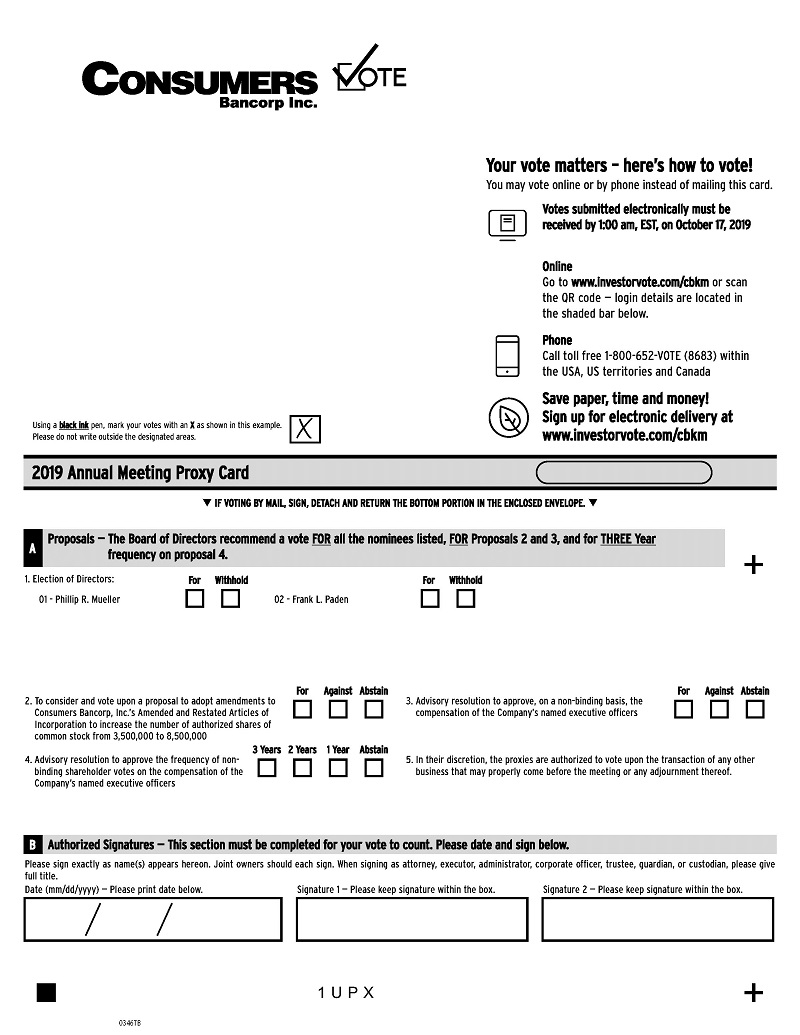

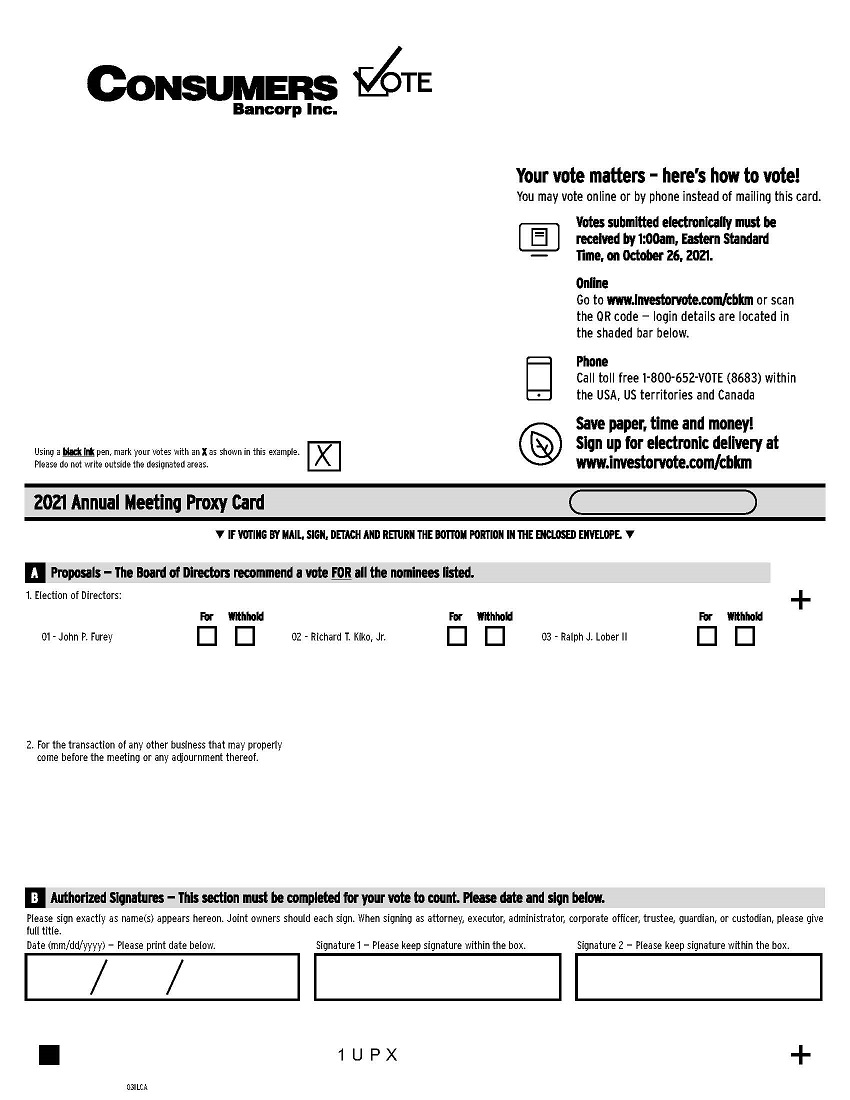

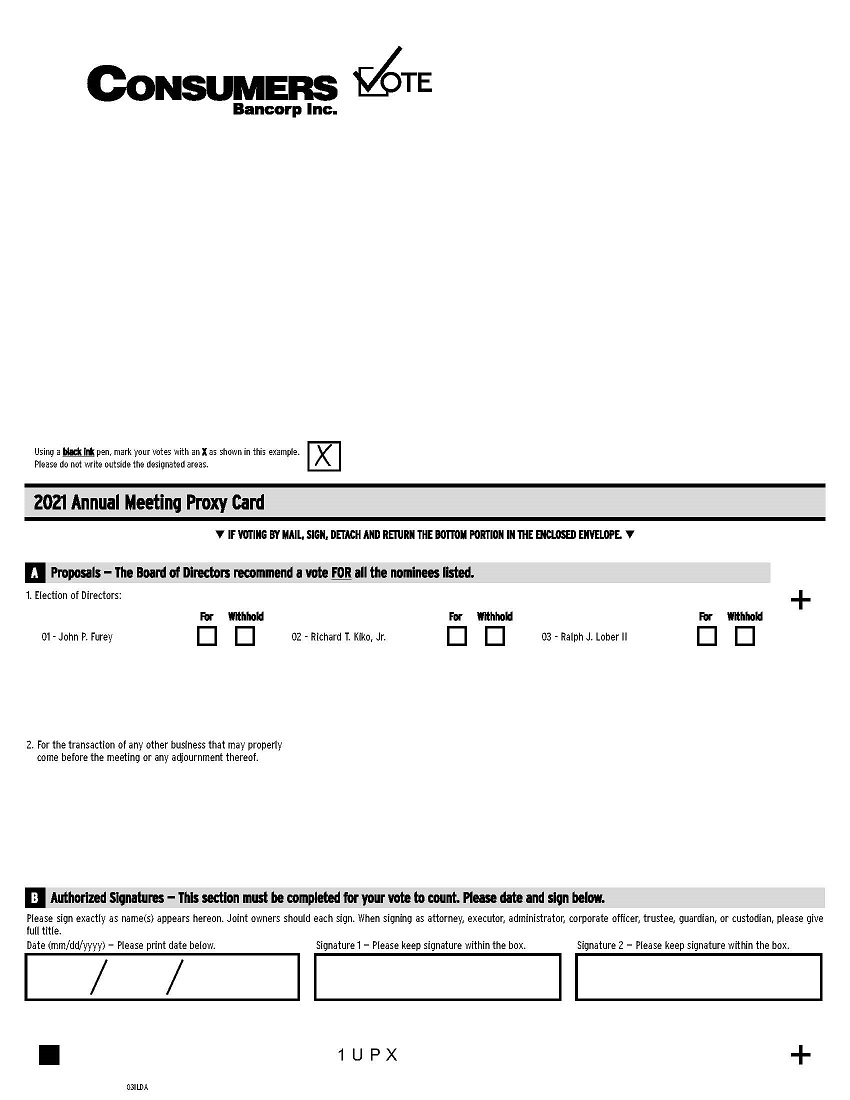

Proxies solicited by the Board of Directors will be voted in accordance with the instructions given, unless revoked. Where no instructions are provided, all properly executed proxies will be voted (1) for the election to the Board of Directors of all director nominees for Class I directors named in this Proxy Statement; (2) for the amendment to Consumers Bancorp, Inc.’s Amended and Restated Articles of Incorporation to increase the number of authorized shares of common stock to 8,500,000; (3) for the adoption of the advisory resolution to approve the compensation of the Company’s named executive officers; (4) three years for the advisory resolution to approve the frequency of non-binding shareholder votes on the compensation of the Company’s named executive officers; and (5)(2) at the discretion of the holders of the proxies, on such other business that may properly come before the meeting or any adjournment thereof.

The shareholders present in person or by proxy shall constitute a quorum. The twothree nominees receiving the highest number of votes cast, including votes cast cumulatively, shall be elected Directors. Abstentions will be counted in establishing the quorum and will be counted as voting (but not for or against) on each of Proposals 1, 3 and 4. For Proposal 2, abstentions will have the same effect as shares voted against.affected proposal. Broker non-votes will be counted for purposes of establishing a quorum but will not be counted as voting on each of Proposals 1, 2, 3 and 4.voting. A proxy may be revoked at any time before it is voted by providing written notice to Consumers Bancorp, by submitting a later dated proxy or by voting in person at the Annual Meeting. Any written notice revoking a proxy should be sent to Ms. Theresa Linder, Secretary, Consumers Bancorp, Inc., P.O. Box 256, Minerva, Ohio 44657.

PROPOSAL 1

ELECTION OF DIRECTORS

Election of Directors

The Board of Directors, acting through the Corporate Governance/Nominating Committee, is responsible for identifying and evaluating candidates for Board membership. TheEffective March 11, 2021, the Board currently consists of ten membersDirectors approved the appointment of Michael A. Wheeler as a Class I director and theShawna L. L’Italien as a Class II director. The Company’s Amended and Restated Articles of Incorporation provides that the Board of Directors be divided as equally as possible into three classes designated as Class I, Class II and Class III. Generally, the directors in each class are elected to serve staggered three-year terms so that the term of office of one class of directors expires at each annual meeting. Currently, the Board consists of Directors has twoten members with three directors in Class III with terms expiring in 2021, three directors in Class I with terms expiring in 2019,2022, and four directors in Class II with terms expiring in 2020, and four directors in Class III with terms expiring in 2021. After the closing of the merger of Peoples Bancorp of Mt. Pleasant, Inc. (Peoples) into Consumers Bancorp, Consumers will select a member of Peoples’ board of directors to become a member of Consumers’ board of directors. Consumers expects the person selected to become a Class I director.2023.

The term of office of current Class IIII directors Phillip R. MuellerJohn P. Furey, Richard T Kiko, Jr, and Frank L. PadenRalph J. Lober II will expire at the annual meeting on October 17, 2019. The current26, 2021. John P. Furey, Richard T Kiko, Jr, and Ralph J. Lober II, constitute the Class I directors constitute theIII nominees to be elected to serve until the 20222024 annual meeting or until their successors are elected and qualified. Additional information concerning the nominees for director, the directors and executive officers of Consumers Bancorp is provided in the following pages.

The common shares represented by the accompanying proxy will be voted for the election of the nominees to serve as directors unless contrary instructions are indicated on the proxy card. The nominees for director receiving the greatest number of “for” votes will be elected as directors. If the election of directors is by cumulative voting, the persons appointed by the accompanying proxy intend to cumulate the votes represented by the proxies they receive and distribute such votes in accordance with their best judgment, unless authority to vote for any or all nominees is withheld.

If one or more of the nominees should at the time of the Annual Meeting be unavailable or unable to serve as a director, the common shares represented by the proxies will be voted to elect the remaining nominees and any substitute nominee or nominees designated by the Board of Directors. The Board of Directors knows of no reason why any of the nominees will be unavailable or unable to serve.

The Board of Directors recommends that the shareholders vote “FOR”“FOR”

the election of the nominees for Class IIII directors.

DIRECTORS AND EXECUTIVE OFFICERS

Director Nominees for Election at the Annual Meeting

Class IIII Directors – Term ending in 20192021

Phillip R. MuellerJohn P. Furey (age 71)69) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since November 2016.August of 1995 and was appointed Vice Chairman of the Board in June 2015. Mr. MuellerFurey is aan independent member of the Audit/RiskCompensation Committee, Loan Committee and Asset/Liability Committee. Mr. Mueller took over the operation of the Minerva Dairy, America’s oldest family owned cheese and butter dairy, in 1976 and currently serves as its Chief Executive Officer. He brings to the bank over 52 years of experience in wholesale and retail sales of dairy products, which includes expertise in dairy technology, agriculture, manufacturing, research and development, production, quality control, finance and human resources. Mr. Mueller received the Young Professional Achievement Award from Ohio State University in 1981. He is involved in professional and community organizations serving in various leadership roles, including past President of the Mid-West Dairy Association, past President of the Rotary Club of Minerva, Rotarian Paul Harris Fellow and the current Chairman of the Rotary Youth Exchange.Executive Committee. In June 2018, Mr. Furey retired as the Corporate President of Furey’s Wheel World, Inc., located in Malvern, Ohio, an automotive retail sales business. He is a Licensed Pilot, Certified Flight Instructor and Aircraft Builder. During his career in the automotive industry, he served on several automotive and finance advisory boards and has a strong management background with extensive knowledge in automotive sales, marketing, financing and customer service. Over his 26-year history as a director of Consumers, Mr. Furey has served on various standing and ad hoc committees and has developed a strong background in community banking.

Frank L. PadenRichard T. Kiko, Jr. (age 68)55) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since January 2015. Mr. Kiko is an independent member of the Asset/Liability Committee, the Corporate Governance/Nominating Committee and the Risk & Technology Committee. He is currently President and a director on the Board of Coletta Holdings Inc., which includes the following holdings: Russ Kiko Associates Inc., Richard T. Kiko Agency, Inc. and Kiko Auctioneers & Realtors, Canton, Ohio. Mr. Kiko is also the President of Futuregen LLC, a private finance company. Prior to joining the family business, Mr. Kiko was a Director and Vice President of Foodservice & Industrial Business for Eagle Family Foods, Inc. He brings a broad range of experience in sales, marketing, logistics, manufacturing, finance, and general management to the Board of Directors. As a third-generation auctioneer and realtor, Mr. Kiko specializes in working with large clients, land, commercial real estate, and mineral rights, which has benefited Consumers and broadened the expertise of the Board.

Ralph J. Lober II (age 54) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since 2008. Mr. Lober is currently the President and Chief Executive Officer, first joining the Company in 2007 as Executive Vice President and Chief Operating Officer. Mr. Lober was promoted to President and was appointed to Consumers National Bank’s Board of Directors in January 2008. Mr. Lober currently is a member of the Asset/Liability Committee (Chairman) and Loan Committee. Having served as Executive Vice President and Chief Financial Officer at Morgan Bank National Association from 1999 until May of 2007, Mr. Lober has a strong background in finance, funds management and operations. Mr. Lober is a certified public accountant licensed in Ohio and Pennsylvania and a graduate of the Graduate School of Banking at The University of Wisconsin-Madison. He serves on the boards and executive committees of several industry and community organizations.

Members of the Board of Directors Continuing in Office

Class I Directors – Term ending in 2022

John W. Parkinson (age 56), formerly a member of Peoples Bancorp of Mt. Pleasant, Inc. board of directors, was appointed to serve as a Director of Consumers Bancorp, Inc. and Consumers National Bank on January 1, 2020. He is an independent member of the Audit Committee, the Risk & Technology Committee, and the Asset/Liability Committee. Mr. Parkinson is President, Chief Compliance Officer of Appalachian Capital Management Ltd., a firm he founded in 1990, which provides money management for individuals, trusts, non-profits, and corporations. He has a Bachelor of Science degree from The Ohio State University and is a Certified Financial Planner. Mr. Parkinson served as a member of Peoples Bancorp of Mt. Pleasant, Inc. and The Peoples National Bank of Mount Pleasant board of directors since 2005 prior to joining Consumers boards in 2020.

Frank L. Paden (age 70) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since July of 2013. He is an independent member of the Executive Committee, Loan Committee and Chairman of the Audit/RiskAudit and Compensation Committees. Mr. Paden formerly served in several executive positions at Farmers National Bank of Canfield for 3738 years and brings extensive financial expertise.expertise to the Board of Directors. Mr. Paden served as President and Chief Executive Officer at Farmers National Bank of Canfield from 1996 until he was appointed Executive Chairman of the Board in 2010. Mr. Paden served as Executive Chairman until September 2011, at which time he retired. Mr. Paden is currently a trustee withof Hiram College, serving on the Finance Committee, Student/Athlete Board Committee, and as Chairman of the Audit/RiskAudit Committee. He is also Treasurer for the Board of the Mahoning County Agriculture Society’s Canfield Fair, serves as a Trustee with the Circle of Friends Foundation and as Vice President of the Children’s Circle of Friends.

MembersMichael A. Wheeler (age 37) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since March 2021. He is an independent member of the BoardAsset/Liability Committee, Compensation Committee and the Risk & Technology Committee. Mr. Wheeler serves as President and Chief Legal Officer of Patriot Software, a Canton Ohio based payroll and accounting software firm. At Patriot Software for 15 years, Mr. Wheeler handles most business, legal, and financial aspects of the company. He is a graduate of the University of Mount Union and the University of Akron School of Law. He also serves on the boards and advisory committee of several community organizations.

Class II Directors –Directors Continuing Term ending in Office2023

Class II Directors – Term ending in 2020

Bradley Goris (age 65)67) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since January of 2011. Mr. Goris is an independent member of the Compensation Committee and the chairman of the Corporate Governance/Nominating Committee, Asset/Liability Committee and Audit/the Risk Committee.& Technology Committees. He is a retired agent of the Goris-Meadows Insurance Agency in Alliance, Ohio, and past Vice-President of the A.A. Hammersmith Insurance Agency in Massillon.Massillon, Ohio. He is currently the managing member of Goris Properties, LLC, a family real estate development and management firm in Alliance. Mr. Goris’ experience and commitment to local service and nonprofit organizations supports Consumers National Bank’s community bank philosophy.

David W. Johnson Laurie L. McClellan(age 59) (age 68) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since July of 1997. He is an independent member of the Asset/Liability Committee, Compensation Committee and chairman of the Corporate Governance/Nominating Committee. Mr. Johnson has been in the tile manufacturing business since 1982. He is currently the Chief Executive Officer of Summitville Tiles, Inc., located in Summitville, Ohio, and previously served as President and Vice President of Administration. He is currently President of Spread Eagle Tavern & Inn, serving in that capacity since 1990, a fine dining restaurant and restored inn in Hanoverton, Ohio. Mr. Johnson is a Partner in PCJ Ltd. and Johnson Joint Venture, both family holding companies. Mr. Johnson has extensive management knowledge, business experience and is dedicated to community and civic affairs, serving on various educational, political and business boards and in June 2011, he was appointed by Governor Kasich to serve on the Board of the Ohio Bureau of Workers Compensation. In May 2018, he was elected Treasurer of the Ohio Republican Party. As a leader in manufacturing, Mr. Johnson has represented the industry at both the State and Federal levels. Having served as Chairman of the Corporate Governance/Nominating Committee and as member of the Asset/Liability Committee since joining the Board, Mr. Johnson has a strong history in bank governance.

Laurie L. McClellan (age 66) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since October of 1987 and as Chairman of the Boards since March of 1998. Ms. McClellan is a member of the Executive Committee and the Loan Committee. Prior to her retirement effective October 1, 2018, Ms. McClellan performed internal corporate duties with an emphasis on investor and community relations and was named the Director of Shareholder Relations for Consumers Bancorp, Inc. in 2011. Prior to becoming Chairman, she served as Corporate Secretary and Vice Chairman of the Boards. Ms. McClellan was the Manager of the Romain Fry Investment Company, LLC and serves on various community and nonprofit advisory boards. She has 3234 years of experience in community banking with an extensive knowledge of the Company’s history and operations and has a strong understanding of banking regulation and compliance.

Harry W. Schmuck, Jr., Jr. (age 70)72) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since November of 2005. Mr. Schmuck is an independent member of the Audit/RiskAudit Committee, the Corporate Governance/Nominating Committee, the Executive Committee and Chairman of the Loan Committee. He is the Operations Manager of Schmuck Partnership, an Agricultural Business,agricultural business, working in the business since 1970, and a Farm Sales Associate of Russ Kiko & Associates, Inc. Mr. Schmuck brings experience in agricultural products and livestock sales and valuation. He is responsible for guiding the Schmuck Partnership in investment decisions and has a firm understanding of management, operations and marketing. He has served on various community agencies and boards. His knowledge in agriculture has benefited the Loan Committee in analyzing farm credits since joining the Board in 2005.

Class III Directors – Term ending in 2021

Shawna L’Italien

John P. Furey (age 67) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since August of 1995 and was appointed Vice Chairman of the Board in June 2015. Mr. Furey is an independent member of the Audit/Risk Committee, Loan Committee and serves as the Chairman of the Executive Committee. In June 2018, Mr. Furey retired as the Corporate President of Furey’s Wheel World, Inc., located in Malvern, Ohio, an automotive retail sales business. He is a Licensed Pilot, Certified Flight Instructor and Aircraft Builder. During his career in the automotive industry he served on several automotive and finance advisory boards and has a strong management background with extensive knowledge in automotive sales, marketing, financing and customer service. Over his 24-year history as a director of Consumers, Mr. Furey has served on various standing and ad hoc committees and has developed a valuable background in community banking.

Richard T. Kiko, Jr. (age 53) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since January of 2015. Mr. Kiko is an independent member of the Asset/Liability Committee, the Corporate Governance/Nominating Committee and the Audit/Risk Committee. He is currently President and a director on the Board of Coletta Holdings Inc., which includes the following holdings: Russ Kiko Associates Inc., Richard T. Kiko Agency, Inc. and Kiko Auctioneers & Realtors, Canton, Ohio. Mr. Kiko is also the President of Futuregen LLC, a private finance company. Prior to joining the family business, Mr. Kiko was a Director and Vice President of Foodservice & Industrial Business for Eagle Family Foods, Inc. He brings a broad range of experience in sales, marketing, logistics, manufacturing, finance and general management. As a third-generation auctioneer and realtor, Mr. Kiko specializes in working with large clients, land, commercial real estate and mineral rights, which has benefited the bank and broadened the expertise of the Board.

Thomas M. Kishman (age 70)50) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since March of 1995. Mr. Kishman2021. Ms. L’Italien is an independent member of the CompensationAudit Committee, LoanCompensation Committee and the ExecutiveCorporate Governance/Nominating Committee. HeShe is currently the co-owner of Kishman’s IGA and Gulf GasNGo located in Minerva, Ohio, a retail grocery and fuel center. Mr. Kishman has spent his entire career in retail sales, workingpartner in the family’s grocerySalem office of Harrington, Hoppe, and Mitchell, Ltd and serves on the firm’s Management Committee. Practicing law since 1996, she focuses her practice on business since 1964. He has a strong management backgroundorganization, commercial and is a dedicated memberreal estate transactions, succession planning, elder law, and supporter of the local community. Serving as past Chairman of the Audit Committee and as a member of the Corporate Governance/Nominating Committee for 15 years, Mr. Kishman has a good understanding of banking risks and controls.

Ralph J. Lober, II (age 52) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since 2008. Mr. Loberestate planning. She is currently the President and Chief Executive Officer, first joining the Company in 2007 as Executive Vice President and Chief Operating Officer. Mr. Lober was promoted to President and was appointed to Consumers National Bank’s Board of Directors in January 2008. Mr. Lober currently is a Member of the Asset/Liability Committee (Chairman) and Loan Committee. Having served as Executive Vice President and Chief Financial Officer at Morgan Bank National Association from 1999 until May of 2007, Mr. Lober has a strong background in finance, funds management and operations. Mr. Lober is a certified public accountant licensed in Ohio and Pennsylvania and a graduate of the Graduate SchoolUniversity of Banking in Madison, Wisconsin. He is active inMount Union and the community servingOhio State University Moritz College of Law. She serves on the boards and executive committees of several industry andvarious community organizations.

THE BOARD OF DIRECTORS AND

ITS COMMITTEES

The Board of Directors conducts its business through meetings of the Board and its committees. Currently, each member of the Board of Directors of Consumers Bancorp also serves as a member of the Board of Directors of Consumers National Bank. Consumers Bancorp held 1512 Board meetings and Consumers National Bank each held 1416 Board meetings during the 20192021 fiscal year. All directors, except Mr. Johnson, attended at least 75% of the total number of meetings of the Board of Directors and meetings held by all committees of the Board on which they served during the 20192021 fiscal year. The Company has determined that all directors, except Ms. McClellan and Mr. Lober, are “independent” directors under the listing standards of the NASDAQ Stock Market Marketplace Rules and qualify as “non-employee directors” for the purposes of Rule 16b-3 under the Securities Exchange Act of 1934, as amended, and meet the additional independence requirement of the Company by beneficially owning less than 5% of the Company’s stock. In addition, former director James V. Hanna did not meet these independence standards at the time of his service during the 2019 fiscal year.amended.

Although the Company does not have a formal policy with respect to Board member attendance at the annual meeting of shareholders, each member is encouraged to attend. All Board members attended the 20182021 Annual Meeting of Shareholders.

Consumers Bancorp has an Asset/Liability Committee, Audit/RiskAudit Committee, Compensation Committee, Corporate Governance/Nominating Committee, Executive Committee, Loan Committee and LoanRisk & Technology Committee, each of which serves in dual capacity as a committee of Consumers Bancorp and Consumers National Bank.

The Asset/Liability Committee is comprised of Mr. Goris, Mr. Johnson, Mr. Kiko, Mr. MuellerParkinson, Mr. Wheeler and Mr. Lober, who serves as chairman. The Asset/Liability Committee is primarily responsible for ensuring both Consumers Bancorp and Consumers National Bank have adequate investment and funds management policies. The committee makes recommendations relative to the strategic direction of the Company and establishes key benchmarks relative to performance. The Asset/Liability Committee is also responsible for establishing procedures for monitoring the management of the investment portfolio and Consumers National Bank’s liquidity, capital and interest rate risk position. During the 20192021 fiscal year, the Asset/Liability Committee met four times.

The Audit/RiskAudit Committee is comprised of Ms. L’Italien, Mr. Furey, Mr. Goris, Mr. Kiko, Mr. Mueller,Parkinson, Mr. Schmuck and Mr. Paden, who served as chairman. The primary function of the Audit/RiskAudit Committee includes the review and oversight of the financial reporting process, internal control environment and the risk management process, including enterprise risk management. Also, the Audit/RiskAudit Committee provides oversight of all internal and external audit functions and the approval and engagement of the Company’s independent auditors and loan review consultants. The Audit/RiskAudit Committee Charter is available on the Company’s website at www.consumersbank.com.www.consumers.bank. The Board of Directors of Consumers Bancorp has determined that each member of the Audit/RiskAudit Committee meets the independence standards of the NASDAQ Stock Market Marketplace Rules and qualifies as “non-employee directors” for the purposes of Rule 16b-3 under the Securities Exchange Act of 1934, as amended. In addition, the Board has determined that Mr. Paden satisfies the requirements of a “financial expert” as defined by the applicable Security and Exchange Commission rules and regulations. The Report of the Audit Committee is on page 1916 of this Proxy Statement. During the 20192021 fiscal year, the Audit/RiskAudit Committee met fivefour times.

The Compensation Committee reviews overall bank compensation policies and executive management compensation. This committee is comprised of Mr. Furey, Mr. Goris, Ms. L’Italien, Mr. Johnson, Mr. KishmanWheeler and Mr. Paden, who serves as chairman. The Board of Directors of Consumers Bancorp has determined that each member of the Compensation Committee meets the independence standards of the NASDAQ Stock Market Marketplace Rules and qualifies as “non-employee directors” for the purposes of Rule 16b-3 under the Securities Exchange Act of 1934, as amended. Our compensation philosophy and objectives are described in the Compensation Discussion and Analysis section of this Proxy Statement. During the 20192021 fiscal year, the Compensation Committee met four times. The Compensation Committee Charter is available on the Company’s website at www.consumersbank.com.www.consumers.bank.

The Loan Committee is comprised of Mr. Furey, Mr. Kishman, Mr. Lober, Ms. McClellan, Mr. Paden and Mr. Schmuck, who serves as chairman. The Loan Committee reviews the lending policies and monitors the Loan Administration’s compliance with such policies, ensures that management’s handling of credit risk complies with Board decisions about acceptable levels of risk, ensures management follows appropriate procedures to recognize adverse trends, takes any needed corrective actions and maintains an adequate allowance for loan and lease losses. The Loan Committee is also responsible for approving loans that exceed the Internal Loan Committee’s lending authority. During the 20192021 fiscal year, the Loan Committee met 1832 times.

A separate Risk & Technology Committee was established during the 2021 fiscal year and is responsible for the oversight of the Company’s information technology program and risk management process, including Enterprise Risk Management. The Committee shall approve and recommend to the Board of Directors the Company’s risk management framework, including risk, policies, processes, and procedures. Also, the Committee oversees the Information Security Program, key system selection and performance evaluation, vendor management and the business resumption planning process. The Risk & Technology committee is comprised of Mr. Kiko, Mr. Parkinson, Mr. Wheeler and Mr. Goris, who serves as the chairman. During the 2021 fiscal year, the Risk & Technology Committee met once.

The Executive Committee reviews and approves new products, servicesmonitors the organizational goals, strategic planning process, and key vendor relationships. Allany merger and acquisition opportunities. In addition, all major functions are subject to the review and approval of the Executive Committee, including, but not limited to, new initiatives, business resumption planningnew products, services, key vendor relationships, key insurance policies and ongoing processes for information technology, information security, deposit operations and facilities.significant legal matters. The committee also reviews various executive and interim Board matters as outlined by its charter. This committee is comprised of Mr. Kishman,Schmuck, Ms. McClellan, Mr. Paden, and Mr. Furey, who serves as the chairman. During the 20192021 fiscal year, the Executive Committee met fivefour times.

The Corporate Governance/Nominating Committee is responsible for the selection of individuals for nomination or re-election to the Board of Directors, making independent recommendations to the Board of Directors as to best practices for Board governance and conducting an evaluation of Board performance. The Corporate Governance/Nominating Committee is comprised of Mr. Goris,Ms. L’Italien, Mr. Kiko, Mr. Schmuck and Mr. Johnson,Goris who serves as chairman. The Board of Directors of Consumers Bancorp has determined that each member of the Corporate Governance/Nominating Committee meets the independence standards of the NASDAQ Stock Market Marketplace Rules. During the 20192021 fiscal year, the Corporate Governance/Nominating Committee met three times.

Under the terms of the Corporate Governance/Nominating Committee Charter, the committee is responsible for developing and implementing a process and guidelines for the selection of individuals for nomination to the Board of Directors and considering incumbent directors for nomination for re-election. The Corporate Governance/Nominating Committee will consider candidates for director who are recommended by shareholders in accordance with the Company’s Amended and Restated Regulations and the Board Addition/Replacement Procedures found in the Board and Management Succession Policy. As part of its considerations, the Corporate Governance/Nominating Committee places value on having directors with experiences and expertise that are diverse from other Board members. Candidates must be individuals with a good reputation who demonstrate civic character, business success and community involvement. They must be willing to commit their time to Board and committee meetings, keep apprised of banking issues and complete continuing education courses. The Corporate Governance/Nominating committee is responsible for the selection of the final slate of nominees for election to the Board of Directors. Those nominees recommended by the Committee are then submitted to the Board of Directors for approval. The Corporate Governance/Nominating Committee Charter is available on the Company’s website at www.consumersbank.com.www.consumers.bank.

Shareholders desiring to nominate a candidate for election as a director at the 20202022 Annual Meeting of Shareholders, other than for inclusion in Consumers Bancorp’s proxy statement and form of proxy, must deliver written notice to the Secretary of Consumers Bancorp, at its executive offices, 614 East Lincoln Way, Minerva, Ohio 44657, not later than July 31, 2020August 5, 2022 or such nomination will be untimely. Consumers Bancorp reserves the right to exercise discretionary voting authority on the nomination if a shareholder has failed to submit the nomination by July 31, 2020August 5, 2022, or if the candidate does not meet the criteria set forth in the Company’s Amended and Restated Regulations.

Board Leadership Structure; Role in Risk Oversight

In accordance with our regulations, the Board elects our Chairman and Chief Executive Officer, or CEO, and both of these positions may be held by the same person or may be held by different people. Currently the offices of Chairman and CEO are separated. The Board believes that the separation of offices of the Chairman and CEO is appropriate at this time as it allows our CEO to focus primarily on management and operating responsibilities.

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including economic risks, financial risks, legal and regulatory risks, and others, such as the impact of competition. Management is responsible for the day-to-day management of the risks that we face, while the Board, as a whole and through its committees, has responsibility for the broad oversight of risk and the establishment of risk tolerances. In its risk oversight role, the Board is responsible for satisfying itself that the risk management processes designed and implemented by management are adequate and functioning as designed.intended.

Director CompensationInsider Trading Policy and Anti-hedging

Under our Insider Trading Policy, each executive officer and director of the Company is prohibited from buying or selling our securities when he or she is aware of material, non-public information about the Company, or information about other public companies which he or she learns as our executive officer or director. These individuals are also prohibited from providing such information to others. In addition, this policy prohibits executive officers and directors from purchasing Company common stock on margin, engaging in short sales, or buying or selling derivative securities.

Director Compensation

Board of Director compensation differs from the compensation programs offered to executives and employees of the Company. To focus on a pay for time and expertise philosophy, the compensation for the Board of Directors is limited to a set fee for service (retainer and meeting fees) and equity compensation (stock or restricted stock). The overall philosophy is to compensate the Board of Directors at the market median (50th percentile) of comparable financial institutions within the region of similar asset size. To provide the proper mix of compensation elements to meet the needs of the Board of Directors, the following elements will be included to compensate directors for their time and expertise; retainer, meeting fees, and committee fees. Additionally, the Company will grant the directors equity compensation to ensure the directors are shareholders and are financially linked to the shareholders they represent. The Compensation Committee annually reviews and recommends to the Board of Directors the proposed director fees after consideration of information from peer surveys, past compensation practices and the Company’s performance. The Board is responsible for approving the fees for attending Board meetings and committee meetings. The Board believes the fees are competitive with the fees paid by other peer banks of a comparable size and will ensure the Company attracts and retains qualified Board members. A peer group analysis was completed during the 2021 fiscal year by Blanchard Consulting Group that was used to establish the annual retainer, board meeting compensation and the committee meeting fees.

Fees Paid in Cash

Non-employee directors receive an annual retainer and are compensated for each Consumers National Bank Board of Directors meeting and each committee meeting they attend. ForIn January 2021, the 2019 fiscal year, the annual retainer for each non-employee director was $7,000increased to $13,500 per year and the compensation for attendance at a Board of Directors meeting was $1,000 per meeting. The Chairman of the Board receives an additional $10,000 and the Vice Chairman received an additional $2,000 per year for serving in those capacities. The following table details the fees paid to each non-employee director for attendance at committee meetings:

Asset/ Liability | Audit/ Risk | Compensation | Corporate Governance/ Nominating | Executive | Loan | Asset/ Liability | Audit | Compensation | Corporate Governance/ Nominating | Executive | Loan | Risk & Technology | ||||||||||||||||||||||||||||||||||||||||

Committee Chair | $ | * | $ | 300 | $ | 200 | $ | 200 | $ | 300 | $ | 200 | $ | * | $ | 300 | $ | 200 | $ | 200 | $ | 300 | $ | 200 | $ | 300 | ||||||||||||||||||||||||||

Committee Member | $ | 100 | $ | 200 | $ | 100 | $ | 100 | $ | 200 | $ | 100 | $ | 100 | $ | 200 | $ | 100 | $ | 100 | $ | 200 | $ | 100 | $ | 200 | ||||||||||||||||||||||||||

* Denotes committee chaired by an employee of the Company

Equity Compensation

Under the 2010 Omnibus Incentive Plan, Stock Awards may be granted to all directors if certain specified performance targets as established by the Compensation Committee are achieved. For the 20192021 fiscal year, the Compensation Committee selected net incomereturn on average equity and total stock return as the Company’s performance targettargets and stock grants associated with meeting the performance targettargets will be awarded on September 12, 201916, 2021, with the issuance of the Company’s financial statements. The total value of stock granted to all non-employee directors for the 2021 fiscal year, 2019, as determined by the Compensation Committee, is equal to 15%40% of the total cash fees earned by the directors during the 2021 fiscal year, 2019.or $12,229 per director who was on the Board for the whole year and $3,057 per director who joined the Board in March 2021.

For the 20192021 fiscal year, Mr. Lober is an employee of Consumers National Bank and received no additional compensation for his service as a director. Effective October 1, 2018, Ms. McClellan retired from her internal corporate duties as the Director of Shareholder Relations but continued her responsibilities as Chairman of the Board of Directors.

The following table summarizes the compensation earned by or awarded to each non-employee director who served on the Board during the 20192021 fiscal year. The compensation received by Mr. Lober is shown in the “Summary Compensation Table” which is included under the “Executive Officers” section in the following pages.

Name | Fees earned or paid in cash | Stock | Total | Fees earned or paid in cash | Stock | Total | |||||||||||||||||||||

John P. Furey | $ | 24,800 | $ | 981 | $ | 25,781 | $ | 29,050 | $ | 4,599 | $ | 33,649 | |||||||||||||||

Bradley Goris | 19,500 | 981 | 20,481 | 24,550 | 4,599 | 29,149 | |||||||||||||||||||||

James V. Hanna (2) | 6,133 | 981 | 7,114 | ||||||||||||||||||||||||

Shawna L’Italien | 7,775 | — | 7,775 | ||||||||||||||||||||||||

David W. Johnson | 17,600 | 981 | 18,581 | 2,500 | 4,599 | 7,099 | |||||||||||||||||||||

Richard T. Kiko, Jr. | 19,200 | 981 | 20,181 | 23,950 | 4,599 | 28,549 | |||||||||||||||||||||

Thomas M. Kishman | 19,200 | 981 | 20,181 | 14,200 | 4,599 | 18,799 | |||||||||||||||||||||

Laurie L. McClellan | 24,050 | 981 | 25,031 | 36,650 | 4,599 | 41,249 | |||||||||||||||||||||

Phillip R. Mueller | 19,000 | 981 | 19,981 | ||||||||||||||||||||||||

Frank L. Paden | 23,100 | 981 | 24,081 | 28,650 | 4,599 | 33,249 | |||||||||||||||||||||

John W. Parkinson | 23,850 | 2,299 | 26,149 | ||||||||||||||||||||||||

Harry W. Schmuck, Jr. | 23,500 | 981 | 24,481 | 30,450 | 4,599 | 35,049 | |||||||||||||||||||||

Michael A. Wheeler | 7,675 | — | 7,675 | ||||||||||||||||||||||||

(1) | The amounts reported in this column represent the grant date value of the stock awards granted during the |

(2) | Mr. |

ForEffective January 1, 2022, the 2020 fiscal year, it is expected that the annual retainer paid to each director will increase to $20,000 per year. The board meeting compensation, and the committee meeting fees and the additional compensation paid to the Chairman of the Board and the Vice Chairman will remain the same as the previous fiscal year. Under the 2010 Omnibus Incentive Plan, stocksame. Stock awards will be made to all directors and executive officers in September 20202022 if certain specified performance targets, as established by the Compensation Committee, are achieved for the 2020 fiscal year.year ending June 30, 2022. The total value of stock granted to all non-employee directors is expected to be in a range of 5%20% to 15%40% of the total cash fees earned by the directors, with each non-employee director receiving an equal amount of the total and the stock will vest on the date of grant.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Security Ownership of Certain Beneficial Owners

Generally, under the rules of the Securities and Exchange Commission, a person is deemed to be the beneficial owner of securities, such as common shares, if such person has or shares voting power or investment power in respect of such securities. In addition, a person is deemed to be the beneficial owner of a security if he or she has the right to acquire such voting or investment power over the security within sixty days, for example, through the exercise of a stock option. Information is provided below about each person known to the Company to be the beneficial owner equal to or more than 5% of the outstanding shares of the Company’s common stock as of June 30, 2019.2021.

Name and Address of Beneficial Owner | Amount and Nature | Percent of | |||||

James V. Hanna 14269 Lincoln S.E. Minerva, OH 44657 | 197,779 | (1) | 7.23 | % | |||

MacNealy Hoover Investment Management Inc 200 Market Ave #200 Canton, OH 44702 | 177,538 | (2) | 6.5 | % | |||

Laurie L. McClellan 28 Tepee Drive Minerva, Ohio 44657 | 140,598 | (3) | 5.1 | % | |||

Name and Address of Beneficial Owner | AmountandNature | Percentof | ||

James V. Hanna 14269 Lincoln S.E. Minerva, OH 44657 | 197,195 (1) | 6.51% | ||

Beese, Fulmer Investment Management, Inc. 200 Market Avenue South, Suite 1150 Canton, OH 44702 | 191,970 (2) | 6.34% |

(1) | Includes |

(2) | Based on a Schedule 13G filing by |

|

|

Security Ownership of Directors and Management

The following table shows the beneficial ownership of the Company’s common stock as of June 30, 2019August 31, 2021 for each director and named executive officer of the Company and for all current directors and executive officers as a group.

Name of Beneficial Owner | Amount and Nature | Percent of | Amount and Nature | Percent of | ||||||

John P. Furey | 44,209 | (1) | 1. | 62% | 46,676 | (1) | 1.54% | |||

Bradley Goris | 8,168 | (2) | * | 11,175 | (2) | * | ||||

David W. Johnson | 17,504 | * | ||||||||

Shawna L’Italien | 2,000 | (3) | * | |||||||

Richard T. Kiko, Jr. | 2,334 | (3) | * | 5,104 | (4) | * | ||||

Thomas M. Kishman | 19,603 | (4) | * | |||||||

Ralph J. Lober, II | 22,988 | (5) | * | |||||||

Ralph J. Lober II | 36,676 | (5) | 1.21% | |||||||

Laurie L. McClellan | 140,598 | (6) | 5. | 14% | 142,336 | (6) | 4.70% | |||

Phillip R. Mueller | 2,072 | (7) | * | |||||||

Frank L. Paden | 4,178 | * | 5,775 | * | ||||||

John W. Parkinson | 13,448 | * | ||||||||

Harry W. Schmuck, Jr. | 17,015 | (8) | * | 19,548 | (7) | * | ||||

Michael A. Wheeler | 1,500 | (8) | * | |||||||

Scott E. Dodds | 3,663 | * | 8,039 | * | ||||||

Renee K. Wood | 8,091 | (9) | * | 13,587 | (9) | * | ||||

All directors and executive officers as a group (14 persons) | 294,133 | 10. | 76% | 316,108 | 10.44% | |||||

* | Denotes less than one percent of outstanding shares. |

(1) | Includes |

(2) | Includes |

(3) | Includes |

(4) | Includes |

(5) | Includes |

(6) | Includes |

(7) | Includes |

(8) | Includes |

(9) | Includes |

ExecutiveExecutive Officers Who Are Not Directors

The following information is provided with respect to each person who currently serves as an executive officer of the Company who does not serve as a director.

Scott E. Dodds (age 57)59) serves as Executive Vice President and Senior Loan Officer. Mr. Dodds joined Consumers in November 2013 as Senior Vice President and Senior Lender. Prior to joining Consumers, Mr. Dodds served as Senior Vice President, Business Banking at FirstMerit Bank. He has served in various financial and banking positions, including: President for Weather Vane Capital, LLC, Senior Vice President, Chief Banking Officer for Ohio Legacy Bank, and Executive Vice President and Retail Banking for Unizan Bank, National Association. Mr. Dodds brings over 2535 years of banking experience in the operations, sales and business development areas of banking. Mr. Dodds is a graduate of the Stonier Graduate School of Banking and BAI Graduate school of Executive Bank Management.

Suzanne Mikes (age 40)42) serves as Senior Vice President, Chief Credit Officer. Ms. Mikes joined Consumers in June 2017 as Vice President, Chief Credit Officer. Prior to joining Consumers, Ms. Mikes served as a Senior Credit Analyst, AVP for CFBank, National Association from 2011 to 2017 and has over 1720 years of credit experience. She completed her undergraduate degree at Mount Union College in 2001 and her MBA at Kent State University in 2007. Ms. Mikes is actively involved in her community and currently volunteers as a Girl Scout Troop Leader and is a member of University of Mount Union’s Business Advisory Council. Ms. Mikes is also a graduate of the Graduate School of Banking at The University of Wisconsin-Madison.

Derek G. Williams (age 60)62) serves as Senior Vice President, Retail Operations and Sales, having been appointed to this position in March 2013. Mr. Williams previously served as Senior Vice President, Training and Sales Development Officer from July 2011 to March 2013. Prior to joining Consumers, Mr. Williams served as Vice President, Senior Business Banker Senior for Huntington Bank and as Senior Vice President, Chief Deposit Officer at Ohio Legacy Bank. Mr. Williams is a graduate of the Bank Administration Institute (BAI) School, Retail Banking Management and has obtained a broad range of retail and commercial experience in his banking career that extends over 4143 years.

Renee K. Wood (age 48)50) serves as Executive Vice President, Chief Financial Officer and Treasurer. Ms. Wood joined Consumers in January 2005 and was appointed the Chief Financial Officer and Treasurer in July 2005. Prior to joining Consumers, Ms. Wood served as Vice President, Controller of the Finance Department for Unizan Bank, National Association from 2002 to 2005. Her 2527 years of banking experience has been inincludes senior or management level positions, primarily in the accounting or finance areas of banking. Ms. Wood is a graduate of the Graduate School of Banking in Madison, Wisconsin.at The University of Wisconsin-Madison.

PROPOSAL 2

PROPOSAL TO AMEND CONSUMERS BANCORP’S AMENDED

AND RESTATED ARTICLES OF INCORPORATION

The Board of Directors has determined that it is advisable to amend the Amended and Restated Articles of Incorporation to increase the number of authorized shares of common stock from 3,500,000 to 8,500,000. The Amended and Restated Articles of Incorporation of Consumers Bancorp currently authorize the issuance of up to 3,500,000 shares of common stock and 350,000 shares of preferred stock. As of June 30, 2019, there were 2,854,133 common shares issued (including 120,288 shares held in treasury) and 2,733,845 shares outstanding. Of the remaining 645,867 authorized but unissued shares of common stock, 88,787 shares are reserved for issuance pursuant to future grants under Stock Plans and 211,535 shares are reserved for issuance pursuant to the Dividend Reinvestment and Stock Purchase Plan. In addition, it is estimated that 269,946 of the currently authorized common shares will be issued in the merger of Peoples into Consumers Bancorp. As a result, after the anticipated closing of the merger, it is estimated that there will be 75,599 shares of common stock and 350,000 shares of preferred stock unreserved and available for future issuance.

While there are no definitive plans for issuing additional shares of common or preferred stock, the Board of Directors believes it is advisable to increase the number of authorized shares of common stock to ensure there is a sufficient number of available shares to undertake a broad range of strategic alternatives and to ensure flexibility in the future. To assist in determining an appropriate number of authorized shares, the Board conducted a review of comparable public banks in order to determine the appropriateness of requesting an increase in the number of authorized shares. Based on this review coupled with the limited amount of unissued shares, the Board of Directors is requesting that shareholders approve an increase in the number of authorized shares of common stock from 3,500,000 to 8,500,000. The Amended and Restated Articles of Incorporation of Consumers Bancorp will be amended as follows.

The FOURTH Article will be deleted in its entirety and the following new FOURTH Article will be inserted in its place:

FOURTH: The aggregate number of shares of stock of all classes which the corporation shall have authority to issue is eight million eight hundred and fifty thousand (8,850,000) shares, of which eight million five hundred thousand (8,500,000) shares shall be common stock with no par value (“Common Stock”) and of which three hundred fifty thousand (350,000) shares shall be preferred stock, with no par value (“Preferred Shares”).

The additional shares of common stock that remain authorized but unissued would be available for issuance at such times and for such purposes as the Board of Directors may deem advisable without further action by Consumers Bancorp’s shareholders, except as may be required by the preemptive rights granted to the shareholders in the TENTH Article of the Amended and Restated Articles of Incorporation or any applicable laws or regulations. We expect authorized but unissued shares of common stock will be issued as part of the Dividend Reinvestment and Stock Purchase Plan. Other purposes for the issuance of shares of common stock may include stock dividends, employee benefit programs, business combinations, acquisitions or other corporate purposes as may be deemed advisable by the Board of Directors. Other than shares issued for the Dividend Reinvestment and Stock Purchase Plan, the Board of Directors has no current plans to issue any shares of common stock to be authorized by the proposed amendment to the Amended and Restated Articles of Incorporation and does not intend to issue any such common stock except on terms or for reasons the Board of Directors would deem to be in the best interests of Consumers Bancorp and its shareholders.

The additional common stock would be available for issuance from time to time for any proper corporate purposes, including in connection with strategic alliances, joint ventures, or acquisitions.

The authorization of additional common stock would not, by itself, have any effect on your rights as a Consumers Bancorp shareholder. The issuance of common stock for corporate purposes, other than a stock split or stock dividend in pro rata distribution to existing shareholders could have, among other things, a dilutive effect on earnings per share and on the equity and voting power of a shareholder at the time of their issuance if a shareholder does not exercise his or her preemptive rights if such rights are available in a given situation.

The affirmative vote of the holders of two-thirds of the outstanding shares of common stock of Consumers Bancorp is necessary for the adoption of the proposed amendment to the Amended and Restated Articles of Incorporation.

Unless otherwise indicated, the accompanying proxy will be voted FOR the proposed amendment to the Amended and Restated Articles of Incorporation.

The Board of Directors recommends that shareholders vote “FOR” the

proposal to amend the Amended and Restated Articles of Incorporation

to increase the number of authorized shares of common stock.

PROPOSAL 3

ADVISORY VOTE ON THE RATIFICATION OF EXECUTIVE COMPENSATION

As required by Section 14A of the Securities Exchange Act, we are seeking advisory shareholder approval of the compensation of the Named Executive Officers as disclosed in this Proxy Statement. This proposal, commonly known as a “Say-on-Pay” proposal, gives you as a shareholder the opportunity to endorse or not endorse our executive pay program through the following resolution:

“RESOLVED, that the compensation of the Company’s Named Executive Officers as disclosed in this proxy statement pursuant to Item 402 of SEC Regulation S-K, including in the Compensation Discussion and Analysis, the Summary Compensation Table, and the related executive compensation tables, notes and narratives, is hereby approved on an advisory, non-binding basis.”

Because your vote is non-binding and advisory, the outcome of the vote will not be binding upon the Board of Directors. However, the Compensation Committee and the Board of Directors will seriously consider the outcome of the vote when considering future executive compensation arrangements.

The Board of Directors believes the Company’s compensation structure is effective in aligning the compensation of the executive officers with the Company’s short-term and long-term goals, and that such compensation and incentives are designed to attract, retain and motivate the executive officers who are directly responsible for the Company’s continued success.

Shareholders are encouraged to carefully review the information provided in this proxy statement regarding the compensation of the Company’s named executive officers in the section captioned “Compensation Discussion and Analysis” of this proxy statement. Currently, the shareholder advisory approval of named executive officer compensation will occur every three years. Subject to the results of Proposal 4 regarding the frequency of the advisory vote on executive compensation, we anticipate the next vote will occur at our 2022 Annual Meeting of Shareholders.

The non-binding advisory resolution regarding the compensation of the named executive officers described in this proposal shall be approved if the votes cast in favor of the resolution exceed the votes cast against the resolution. Abstentions will not be counted as either votes cast for or against the resolution. If no voting specification is made on a properly returned or voted proxy card, the proxies will vote FOR the compensation of the named executive officers.

The Board of Directors recommends that the shareholders vote “FOR”

the adoption of the advisory resolution set forth above.

PROPOSAL 4

ADVISORY VOTE ON FREQUENCY OF VOTES ON EXECUTIVE COMPENSATION

Also, as required by Section 14A of the Securities Exchange Act, a separate proposal is being included to determine whether the advisory shareholder vote to approve the compensation of the named executive officers will occur every one, two or three years.

The Board of Directors is recommending a shareholder vote of every three years since it believes this is the most appropriate timeframe for the Company and its shareholders to evaluate the Company's overall compensation philosophy, design and implementation. A three-year period is more closely aligned with the longer-term view that the Compensation Committee takes with respect to the more significant components of our named executive officers' compensation, and would allow shareholders the opportunity to evaluate the effectiveness of these programs over the time frames that they are intended to generate performance.

When casting your vote on this resolution, you should mark your proxy for every year, every two years, or every three years based on your preference as to the frequency with which an advisory vote on executive compensation should be held. You may also choose to abstain from voting on this proposal. The frequency alternative receiving the highest number of votes will be deemed to be the selection of the shareholders.

The Board of Directors recommends a vote

for “THREE YEARS”

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Introduction and Overview

This Compensation Discussion and Analysis provides information regarding the compensation awarded to, earned by, or paid to the named executive officers serving as of June 30, 20192021 whose compensation is detailed in this proxy statement. These named executive officers are the President and Chief Executive Officer, Chief Financial Officer and Senior Loan Officer. The Board of Directors has delegated to the Compensation Committee responsibility for the oversight and administration of the compensation programs. The committee reviews and recommends company benefit and incentive plans and reviews the individual performance of the Chief Executive Officer and executive management.

Compensation Philosophy and Objectives

The objective of the Company’s compensation program is to fairly compensate the executive officers considering their individual performances and their contributions to the performance of the Company, thereby aligning executives’ incentives with shareholder value creation. The compensation philosophy is designed to reward effort and achievement by the officers and provide them with compensation targeted at market competitive levels. The Company’s compensation program includes the following core components: base salary, cash incentive compensation, equity-based awards, and long-term compensation. The Compensation Committee manages all components on an integrated basis with a goal of achieving the following objectives: to attract and retain highly qualified management, to provide shorter-term incentive compensation that varies directly with the Company’s financial performance and to focus management on both annual and long-term goals. The Company believes that, by setting and adjusting these elements, it has the flexibility to offer appropriate incentives to its executive officers.

From time to time, the Compensation Committee utilizes outside consultants to provide analysis regarding our executive compensation program. Typically this is done once every three years. During the 2019 fiscal year, the Compensation Committee engaged Blanchard Consulting Group to review executive officers’ compensation and to make recommendations regarding the structure of their future compensation packages. Per the Compensation Committee’s instructions, Blanchard performed a market assessment and made recommendations on base salary, incentive pay and benefits for each named executive officer as compared to similar peer banks. For the 2020 fiscal year, Blanchard Consulting Group was last engaged by the Compensation Committee to analyze ourcomplete a peer group analysis for an executive and board compensation program during the 2017 fiscal year.review.

Although the Compensation Committee makes independent determinations on all matters related to compensation of executive officers, certain members of management are requested to attend committee meetings and provide input to the Compensation Committee. Input may be sought from the Chief Executive Officer, human resources, finance, and others as needed to ensure the Compensation Committee has the information and perspective it needs to carry out its duties. The Compensation Committee will seek input from the Chief Executive Officer on matters relating to strategic objectives, company performance goals and input on his assessment of the other executive officers. The Compensation Committee delegates some responsibilities to management to assist in the development of design of the annual incentive compensation program for the Compensation Committee’s consideration. The Compensation Committee does not delegate the determination of compensation of the named executive officers to management.

Components of Compensation

Base Salary

Base salary is a major factor in attracting and retaining key personnel and therefore is the primary component of our executive officer’s compensation. In setting an executive officer’s base salary, the Company considers parameters set by its size and complexity and the salaries offered by peers. The Compensation Committee has adopted the philosophy to target executive compensation to the midpoint of its peer group that was developed for the compensation analysis. The Company’s performance as measured by its results compared to previous years is also considered in determining the overall adjustments to executive officers’ salaries. Specific salaries are adjusted to reflect the contributions of the executive officer to the Company’s operations and the accomplishment of its long-term goals.

Based on a review of the Company’s strategic direction, individual career path objectives and succession planning in conjunction with the broad databases and other publicly available information, the Company believes that its executive compensation practices are in line with its compensation philosophy and objectives described above.

Incentive Compensation

The purpose of the incentive compensation program is to focus executives on achieving and possibly exceeding the Company’s annual performance objectives consistent with safe and sound operations of the Company. Incentive compensation is provided to recognize achievement of annual financial targets and is paid in accordance with the quantitative and qualitative objectives established by the Compensation Committee. In establishing the incentive compensation’s metrics and targets for the 20192021 fiscal year, the Compensation Committee utilized the Company’s budget to set the performance at levels that were determined to be reasonable and achievable. In setting the named executive officers’ awards, the Compensation Committee considered the following three core corporate financial measures: return on average assets (ROA), return on average equity (ROE),net income, efficiency ratio, total delinquency and the efficiency ratio. In addition, each named executive officer was assigned additional metrics based on their specific areas of responsibilitygrowth in total loans and oversight.deposits.

The following table sets forth the core corporate financial metrics, targets, and actual results for the named executive officers:

Target Range | Target Range | ||||||||||||||||||

Metrics | Threshold | Maximum | 2019 Actual | Threshold | Target | Maximum | 2021 Actual | ||||||||||||

ROA | 0.82% | 0.96% | 1.07% | ||||||||||||||||

ROE | 9.48% | 11.21% | 11.96% | ||||||||||||||||

Net Income | $ | 6,825 | $ | 7,000 | $ | 8,700 | $ | 8,988 | |||||||||||

Efficiency Ratio | 71.83% | 67.65% | 71.36% | 64.80 | % | 62.79 | % | 62.78 | % | 61.53 | % | ||||||||

Delinquency | 1.14 | % | 0.83 | % | 0.82 | % | 0.39 | % | |||||||||||

Gross Loans | $ | 473,000 | $ | 483,000 | $ | 523,000 | $ | 566,427 | |||||||||||

Total Deposits | $ | 592,300 | $ | 604,800 | $ | 654,700 | $ | 726,849 | |||||||||||

For the Chief Executive Officer, a range of 8.25%14.0% to 22.0%50.0% of an awardsalary is tied to these core corporate financial measures. For the Chief Financial Officer and Senior Loan Officer, a range of 5.5%11.0% to 16.5%40.0% of an awardsalary is tied to these core corporate financial measures. Performance was assessed after the end of the performance period and cash incentive payments based on the Company’s performance were made only if one or more financial metrics met or exceeded the targets established by the Compensation Committee.

In addition to the corporate components outlined above, the Chief Executive Officer is eligible for a range of 6.75% to 18% and the Chief Financial Officer and Senior Loan Officer are eligible for a range of 4.5% to 13.5% of the award in the form of a discretionary bonus based on the Compensation Committee’s evaluation of each named executive officer’s individual performance goals. During the 2019 fiscal year, the Compensation Committee established the target bonus opportunities under the incentive compensation program for each named executive officer expressed as a percentage of base salary. The following table sets forth such target bonus opportunities for each named executive officer:

| Target Incentive Compensation Opportunity (% of base salary) | |

Named Executive Officer | Threshold | Maximum |

Ralph Lober | 15% | 40% |

Renee Wood | 10% | 30% |

Scott Dodds | 10% | 30% |

Based on both the above performance measures and the Compensation Committee’s assessment of individual performance, the 20192021 cash incentive payments were awarded as follows relative to the 20192021 target value:

Named Executive Officer | 2019 Maximum Target Value ($) | 2019 Cash Incentive Payment ($) (1) | 2021 Maximum Target Value ($) | 2021 Cash Incentive Payment ($) (1) | ||||||||

Ralph Lober | $ 102,174 | $ 81,101 | $ | 155,688 | $ | 155,688 | ||||||

Renee Wood | $ 54,129 | $ 37,890 | $ | 80,432 | $ | 80,432 | ||||||

Scott Dodds | $ 52,950 | $ 39,722 | $ | 80,004 | $ | 80,004 | ||||||

(1) | The amounts included in this column are included in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table. |

Long-term Compensation

Long-term compensation includes a qualified retirement plan in the form of a 401(k) Plan, a non-qualified Salary Continuation Program and the 2010 Omnibus Incentive Plan. The Company provides safe harbor contributions under the 401(k) Plan, matching up to 100% of the first 4.0% contributed by the employee. The amount contributed on behalf of the executive officers is determined in accordance with the provisions of the plan applicable to all employees. The Salary Continuation Plan is designed to retain executive and senior management personnel. Participation in the Salary Continuation Plan is limited and is subject to meeting performance criteria established by the Compensation Committee and approved by the Board of Directors. Under the 2010 Omnibus Incentive Plan, from time to time, stock awards have been made to all directors, all executive officers and certain other senior management personnel. Stock awards will be made in the 20202021 fiscal year since the specified net income performance target astargets established by the Compensation Committee wasof return on average assets and total stock return were achieved for the 20192021 fiscal year. The value of the stock award that will be granted to the Chief Executive Officer will be 25%40% of base salary. The value of the stock award that will be granted to the Chief Financial Officer and Senior Loan Officer will be 17.5%25% of each officer’s base salary. Twenty-five percent of the stock awarded will vest on the grant date, which is the end of the performance period, with the remaining vesting 25% per year over a three-year period. These long-term incentive compensation plans are designed to promote a vested interest in the long-term strategic performance goals of the Company and discourage turnover among its executive officers and other employees.

The following table sets forth the cash compensation and certain other compensation paid or earned by the Company’s principal executive officer, principal financial officer, and one other of the most highly compensated executive officers serving at the end of the 20192021 fiscal year. The individuals listed in this table are sometimes referred to in this Proxy Statement as the “named executive officers.”

Summary Compensation Table

Name and Principal Position | Year | Salary | Bonus | Stock | Option | Non-Equity | Nonqualified | All Other ($) (4) | Total | ||||||||||||||||||||||||

Ralph J. Lober, II | 2019 | $ | 253,560 | $ | 250 | $ | 22,314 | $ — | $ | 81,101 | $ | 93,327 | $ | 9,788 | $ | 460,340 | |||||||||||||||||

| President and Chief Executive Officer | 2018 | 243,607 | 250 | 20,756 | — | 37,190 | 73,893 | 10,241 | 385,937 | ||||||||||||||||||||||||

Renee K. Wood | 2019 | $ | 179,180 | $ | 250 | $ | 15,789 | $ — | $ | 37,890 | $ | 51,953 | $ | 7,491 | $ | 292,553 | |||||||||||||||||

| Executive Vice President, Chief Financial Officer/Treasurer | 2018 | 170,054 | 250 | 13,853 | — | 19,736 | 49,754 | 7,126 | 260,773 | ||||||||||||||||||||||||

Scott E. Dodds | 2019 | $ | 175,249 | $ | 250 | $ | 15,435 | $ — | $ | 39,722 | $ | 46,424 | $ | 15,083 | $ | 292,163 | |||||||||||||||||

| Executive Vice President and Senior Loan Officer | 2018 | 170,250 | 250 | 14,985 | — | 19,294 | 44,427 | 7,739 | 256,945 | ||||||||||||||||||||||||

Name and Principal Position | Year | Salary | Bonus | Stock | Option | Non-Equity | Nonqualified | All Other ($) (4) | Total | |||||||||||||||||||||||||

Ralph J. Lober II | 2021 | $ | 301,221 | $ | 250 | $ | 54,149 | $ | — | $ | 155,688 | $ | 185,664 | $ | 13,812 | $ | 710,784 | |||||||||||||||||

| President and Chief Executive Officer | 2020 | 266,929 | 250 | 63,866 | — | 98,151 | 124,318 | 11,595 | 565,109 | |||||||||||||||||||||||||

Renee K. Wood | 2021 | $ | 197,271 | $ | 250 | $ | 23,236 | $ | — | $ | 80,432 | $ | 76,801 | $ | 9,896 | $ | 387,885 | |||||||||||||||||

| Executive Vice President, Chief Financial Officer/Treasurer | 2020 | 184,490 | 7,750 | 31,579 | — | 56,961 | 57,518 | 7,988 | 346,286 | |||||||||||||||||||||||||

Scott E. Dodds | 2021 | $ | 195,457 | $ | 250 | $ | 22,718 | $ | — | $ | 80,004 | $ | 155,297 | $ | 21,281 | $ | 475,007 | |||||||||||||||||

| Executive Vice President and Senior Loan Officer | 2020 | 180,470 | 250 | 30,888 | — | 55,720 | 50,179 | 19,113 | 336,620 | |||||||||||||||||||||||||

(1) | The amounts in this column represents a $250 Christmas bonus that was paid to each of the named executive |

(2) | The amounts in this column are the grant date fair values of awards of restricted stock. |

(3) | The amounts in this column reflect cash incentive awards. See the discussion under Compensation Discussion and Analysis – Incentive Compensation. |

(4) | All other compensation as reported in this column includes contributions by the Company for each of the named executive officers to the Consumers National Bank 401(k) Savings and Retirement Plan & Trust, dividends on restricted stock, premiums for group term life insurance and perquisites. The perquisites provided for Mr. Dodds are country club dues. These amounts for fiscal year |

Name | Amounts Contributed to 401(k) Plan | Group Term Life Insurance | Perquisites | Total All Other Compensation | Amounts Contributed to 401(k) Plan | Dividends on Restricted Stock | Group Term Life Insurance | Perquisites | Total All Other Compensation | |||||||||||||||||||||||||||

Ralph J. Lober, II | $ | 9,291 | $ | 497 | $ | — | $ | 9,788 | ||||||||||||||||||||||||||||

Ralph J. Lober II | $ | 11,981 | $ | 1,334 | $ | 497 | $ | — | $ | 13,812 | ||||||||||||||||||||||||||

Renee K. Wood | 7,167 | 324 | — | 7,491 | 8,760 | 812 | 324 | — | 9,896 | |||||||||||||||||||||||||||

Scott E. Dodds | 7,010 | 929 | 7,144 | 15,083 | 8,684 | 826 | 929 | 10,842 | 21,281 | |||||||||||||||||||||||||||

The following table sets forth details about the unvested restricted stock awards held by the named executive officers as of June 30, 2019.2021.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 20192021

Stock Awards | Stock Awards | Stock Awards | |||||||||||||||||||||||||||||||||

Name | Grant Date | Number of Shares or Units of Stock that Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) (1) | Equity Incentive Plan Awards: Market Value or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) (2) | Grant Date | Number of Shares or Units of Stock that Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) (1) | Equity Incentive Plan Awards: Market Value or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) (2) | |||||||||||||||||||||||||

Ralph J. Lober, II | 9/12/2018 | — | — | 716 | 13,246 | ||||||||||||||||||||||||||||||

Ralph J. Lober, II | 9/21/2017 | — | — | 494 | 9,139 | ||||||||||||||||||||||||||||||

Ralph J. Lober II | 9/22/2020 | — | — | 2,587 | $ | 50,447 | |||||||||||||||||||||||||||||

Ralph J. Lober II | 9/21/2019 | — | — | 1,757 | 34,262 | ||||||||||||||||||||||||||||||

Ralph J. Lober II | 9/12/2018 | — | — | 239 | 4,661 | ||||||||||||||||||||||||||||||

Renee K. Wood | 9/22/2020 | — | — | 1,110 | 21,645 | ||||||||||||||||||||||||||||||

Renee K. Wood | 9/12/2018 | — | — | 507 | 9,380 | 9/21/2019 | — | — | 869 | 16,946 | |||||||||||||||||||||||||

Renee K. Wood | 9/21/2017 | — | — | 330 | 6,105 | 9/12/2018 | — | — | 169 | 3,296 | |||||||||||||||||||||||||

Scott E. Dodds | 9/12/2018 | — | — | 495 | 9,158 | 9/22/2020 | — | — | 1,085 | 21,158 | |||||||||||||||||||||||||

Scott E. Dodds | 9/21/2017 | — | — | 358 | 6,623 | 9/21/2019 | — | — | 850 | 16,575 | |||||||||||||||||||||||||

Scott E. Dodds | 9/12/2018 | — | — | 165 | 3,218 | ||||||||||||||||||||||||||||||

(1) | Restricted stock awards vest on the anniversary date of the grant based on a three-year vesting schedule. |

(2) | The market value of the awards of restricted stock that have not yet vested was determined by multiplying the closing price of a share of Consumers common stock on June 30, |

DEFINED CONTRIBUTION PLAN